Composition

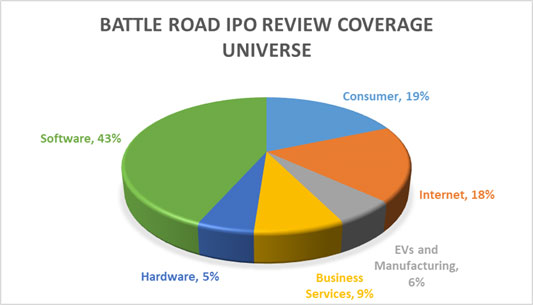

The Battle Road IPO Review universe consists of more than 250 growth-oriented companies which have come public in the last thirteen years in the following sectors: Software, Internet, Hardware, Consumer, EVs and Manufacturing, and Business Services. The current composition of the universe is as follows:

The median market cap of the universe is $4.1 billion, and 65 percent of the universe ranges in value between $100 million and $10 billion. Thus, the primary audience is the small and mid-cap fund manager and analyst.

That said, the coverage universe includes the most important stock offerings in each of the above-mentioned sectors. Thus, Meta Platforms (NASDAQ: META), Tesla Motors (NASDAQ: TSLA), Palo Alto Networks (NYSE: PANW), Mobileye (NASDAQ: MBLY), Snowflake (NYSE: SNOW), and Veeva Systems (NYSE:VEEV) are large cap stocks that are a part of the coverage universe.

In the small and mid-cap range, the universe includes Olo (NYSE: OLO), Everbridge (NASDAQ: EVBG), Momentive Global (NASDAQ: MNTV), Lyft (NASDAQ: LYFT), Shake Shack (NYSE: SHAK), AMC Entertainment (NYSE: AMC), and Peloton Interactive (NASDAQ: PTON).

In recent years, on a select basis, we have added spin-offs, and direct listings, such as Spotify Technology (NYSE: SPOT), Palantir Technologies (NYSE: PLTR), and Asana (NYSE: ASAN) to the Battle Roade IPO Review Coverage Universe.

Beginning in February of 2023, we added a new sector focused on EVs and Manufacturing stocks. The new section recognizes growing client interest in the Electric Vehicle market, and companies whose products are utilized to create sustainable transportation.

With EVs rising to nearly ten percent of all new cars purchased around the world last year, the sector remains one of interest and intrigue.

Among the new companies added to the list are EV OEMS, suppliers, and charging infrastructure companies that came public via the SPAC route, rather than via the traditional initial public offering. The new and expanded EV and Manufacturing sector coverage of the Battle Road IPO Review includes: Tesla (NASDAQ: TSLA), Rivian Automotive (NASDAQ: RIVN), Protolabs (NYSE: PRLB), Ferrari (NYSE: RACE), Mobileye Global (NASDAQ: MBLY), TuSimple (NASDAQ: TSP), Xometry (NASDAQ: XMTR), Lucid Motors (NASDAQ: LCID), Nikola (NASDAQ: NKLA), ChargePoint (NYSE: CHPT), Blink Charging (NASDAQ: BLNK), EVgo (NASDAQ: EVG), and Fisker (NYSE: FSR).

Over 95 percent of the universe is comprised of US securities, though we do add foreign stocks from time to time, when our clients request that they be added to the list, or when we believe the stock will be integral to our sector coverage. Overseas securities included in the coverage universe include MercadoLibre (NASDAQ: MELI), Ferrari (NYSE: RACE), Spotify Technology (NYSE: SPOT), Criteo (NASDAQ: CRTO), trivago (NASDAQ: TRVG), and Atlassian (NASDAQ: TEAM).

.

.